Offshore Banking for Dummies

The European Union has introduced sharing of details between certain territories, and also applied this in regard of specific regulated centers, such as the UK Offshore Islands, to make sure that tax details is able to be shared in respect of passion. The Bank Privacy Act requires that Taxpayers file an FBAR for accounts outside of the United States that have balances over of $10,000 FATCA (the Foreign Account Tax Conformity Act) came to be regulation in 2010 as well as "targets tax non-compliance by US taxpayers with foreign accounts [and] focuses on reporting by United States taxpayers regarding particular international financial accounts and offshore assets [as well as] international banks concerning financial accounts held by united state

If you stated the US, the UK, the significant G7 financial institutions will certainly not deal with offshore bank centers that don't abide by G7 financial institutions guidelines, these financial institutions could not exist (offshore banking). They only exist due to the fact that they take part in purchases with conventional banks." This point of view did not age well in the wake of detractions at Goldman Sachs, Wells Fargo, Barclays, HSBC, and also others.

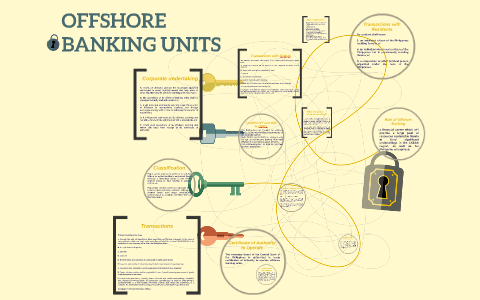

Offshore Banking Interpretation? Offshore banking is merely a term made use of to describe making use of banking services in an international jurisdiction beyond the country where one lives. Any person that owns a financial institution account in an international nation outside of their country of residence is involving in overseas financial.

In the past, there were commonly just a handful of jurisdictions in which financial institutions offered overseas banking solutions, nevertheless, nowadays, one can open up an offshore savings account nearly anywhere. That being stated, there are still certain territories (such as Singapore, Belize, Cayman Islands as well as Switzerland) that are much more renowned for their use as favourable overseas environments that have an excellent blend of financial advantages along with strong banking policies as well as methods.

Offshore Banking - Questions

Offshore Financial Institution Accounts, There are a couple of different methods which one can tackle opening up an global checking account, along with different account types, which we will quickly discover: Personal Account vs. Corporate Account While it is possible to open an exclusive offshore account in your very own individual name, it is usually advised to incorporate an offshore firm in an international jurisdiction and ultimately open up a company account as the firm.

Business accounts are less complicated to open up whereas individual accounts can be harder. Theoretically, presumably less complicated to open up an account in your own name contrasted to undergoing the additional actions of forming an overseas company, however in truth, having a business entity be the owner of the account enables several advantages, Developed banks will typically have much stricter demands for accepting an international person instead of a company.

As a substantial first deposit, and also then there are no assurances of being accepted. 2. A company account offers a lot greater defense as well as privacy. Opening an account for an overseas firm separates and dis-identifies you directly from the account. This means that your properties will be much more secure and also much less open up to unwanted focus - offshore banking.

While they do not supply the very same series of financial investment alternatives as well as top solutions as huge investment accounts, they are beneficial for those who intend to have less complicated accessibility to their funds, make regular purchases, as well as that are just wanting to start their offshore strategy with a tiny as well as simple account.

Offshore Banking for Beginners

We normally advise the last because of the added security, defense that an LLC brings. Remote Account Opening, Specific territories as well as account types provide themselves more to opening up an account remotely (e. g. Belize), and also in certain situations, it might be more practical to open up an account from another location (if, for example, you are just opening up a little account; it may not be economically practical to take a trip completely to the country of choice).

What type of account do you need? What is the purpose of the account? The above information may aid you get a basic suggestion of the kind of overseas account you are looking for, yet for an extra custom-made overseas remedy, it is best to obtain a personal strategy as each country has refined differences that can make all the distinction.

One does not have to look extremely far across the world headlines to see that corrupt routines are still at large. Staying in a high-risk atmosphere, it is only common sense that would intend to have a savings saved in a various place for safekeeping. Even in even more 'autonomous' countries that may not be directly endangering there are still economic and also monetary uncertainties that would intend to be well gotten ready for.

3. Higher-Interest Fees, If you stay in Germany or Japan for example, financial institutions there have negative rates of interest. Thats right, unfavorable. That indicates not just do you not gain any passion on your cost savings, yet you really lose cash. Both Japan and Germany float around minus. 01% - 1.

The Only Guide for Offshore Banking

3%, some overseas financial institutions can obtain upwards of 3-4%, though this may not enough reason alone to financial institution within the jurisdiction, it does tell you that not all financial systems were developed equivalent. 4. Foreign Financial Institutions Have a More Secure Financial System, It is crucial to see to it your possessions are kept in a Putting your wealth in a safe, as well as a lot more notably, reliable financial system is very crucial.

The huge industrial financial institutions really did not even come close - offshore banking. Foreign banks are much more secure option, for one, they call for higher capital books than lots of banks in the United States and UK. While numerous banks in the UK as well as US call for approximately just 5% gets, lots of global financial institutions have a much higher resources get proportion such as Belize and also Cayman Islands which carry ordinary 20% and 25% respectively.

Recommended Reading Clicking Here over here